In case a problem ever arises in your State Sales Tax Calculation, get in touch with us. We are available round-the-clock to simplify your Sales tax woes and answer any queries.

Easily manage your sales tax worries. A hassle-free automated tax calculation process to remit and file your tax amounts. All tax compliance issues will now be a thing of the past.

Supports all states & local tax rules. Besides, automatically preparing your state return-ready reports, so you wouldn’t have to manually create & waste time on endless spreadsheets and CSV’s.

Automation means, you wouldn’t have to do the tedious & laborious tax routines anymore. Taxlity connects you to TaxJar from where your Tax filing becomes easy-peasy. Now, you will find more time to focus on lead generating avenues and business ideas.

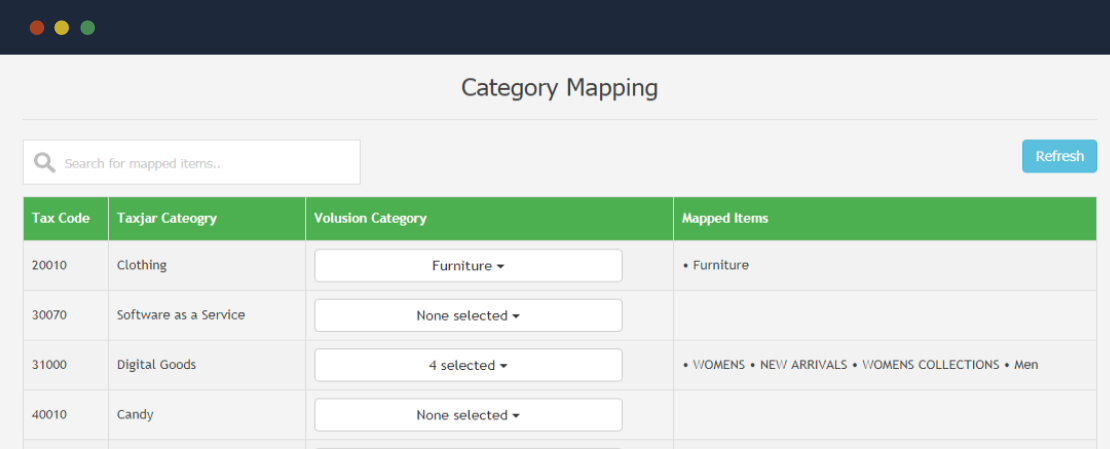

A fantastic feature within Taxlity that helps you to map all the categories that follow a single specific tax rate into one. In the absence of this, the standard TaxJar rate applies. Beyond this, you get to list the Tax-Exempt items as well.

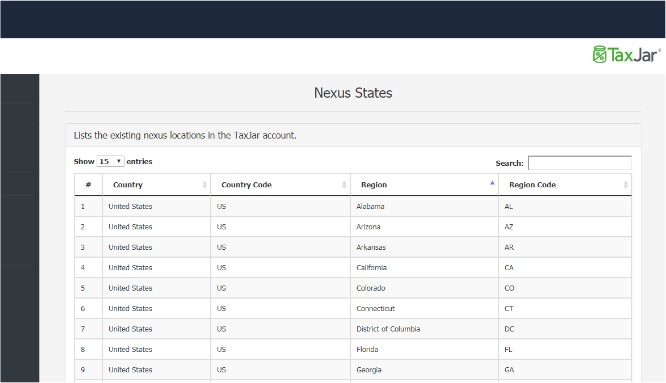

A custom solution designed by the brilliant minds in Virtina, to address all your Volusion jurisdiction wise Sales Tax woes. An API call from Taxlity retrieves the correct data from the client’s orders. Then submits the same to TaxJar, which then helps to determine the corresponding tax for that order & state.

The relevant information requested will be looked up; whenever a merchant accepts an order. The said info is accounted, and the correct sales tax is then brought back in a matter of seconds.

START LEARNING© 2025 All Rights reserved